Is DWAC Stock a Good Investment for Long-Term Holders?

Investors looking to diversify their portfolios often explore various sectors and emerging opportunities. One stock that has garnered significant attention in recent times is Digital World Acquisition Corp. (DWAC). As a special purpose acquisition company (SPAC), DWAC rose to prominence due to its merger with Trump Media & Technology Group (TMTG), the parent company of Truth Social. With such a high-profile association, many investors are asking the crucial question: Is DWAC stock a good investment for long-term holders?

In this article, we will analyze DWAC’s fundamentals, growth potential, risks, and what it might offer to long-term investors.

Understanding DWAC and Its Business Model

Digital World Acquisition Corp. is a SPAC formed with the primary goal of acquiring or merging with a company. Its merger with Trump Media & Technology Group aims to provide a platform that directly competes with mainstream social media giants like Facebook, Twitter, and YouTube.

The main product of TMTG is Truth Social, a social media platform focusing on free speech and conservative viewpoints. The company envisions expanding beyond social media by launching subscription-based streaming services and other digital products.

Key Business Drivers:

- Growing User Base on Truth Social:

The success of DWAC largely depends on the adoption and growth of Truth Social. - Political Influence:

With Donald Trump’s backing, the platform attracts a dedicated user base, especially during politically charged events. - Expansion Plans:

The company aims to expand into digital advertising, cloud services, and subscription content, which could drive long-term growth.

Potential Advantages of Investing in DWAC Stock

1. High Growth Potential in Niche Markets

DWAC targets an underserved market of users seeking alternatives to mainstream social media platforms. With growing political polarization, this niche could continue to expand, providing DWAC with steady user growth and potential revenue streams.

2. Diversification of Revenue Streams

In addition to social media, DWAC’s merger with TMTG plans to offer streaming services and subscription-based content, diversifying its income sources and reducing dependency on one platform.

3. Strong Brand Recognition

The association with Donald Trump gives the company significant visibility and brand recognition. Unlike many startups, DWAC has already established a strong identity and user interest, which could translate into long-term growth if managed effectively.

Risks of Holding DWAC Stock Long-Term

1. Regulatory and Legal Challenges

SPACs, in general, have faced increased scrutiny from regulators. DWAC’s high-profile nature further exposes it to potential legal and regulatory challenges that could affect stock performance.

2. Competitive Market

Competing against established social media giants such as Meta (Facebook) and X (formerly Twitter) poses a significant challenge. DWAC’s long-term success hinges on its ability to differentiate itself and retain users.

3. Political and Market Volatility

DWAC’s stock price is highly influenced by political events and market sentiment. This volatility can make it difficult for long-term investors to predict consistent returns.

Financial Health and Market Performance

While DWAC’s financial health is still evolving as it transitions from a SPAC to a fully operational media company, investors should keep an eye on its revenue growth, user acquisition, and operational expenses.

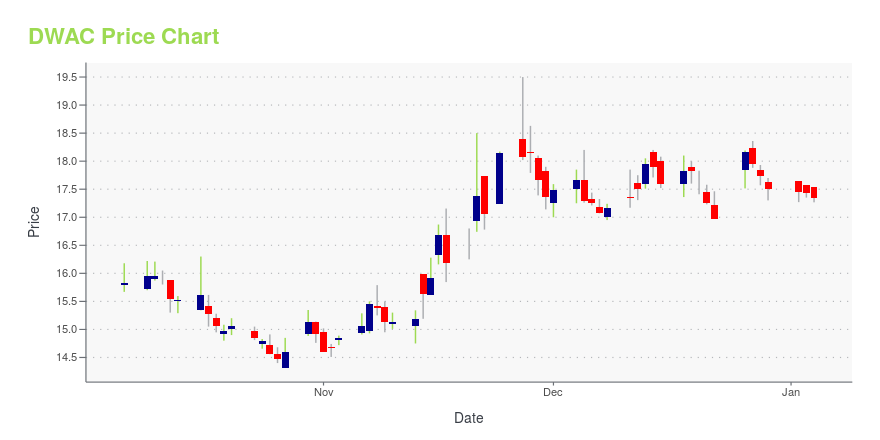

Recent Performance Indicators:

- Stock Volatility: DWAC has experienced significant price swings due to political events and news surrounding the Trump Media merger.

- Revenue Expectations: As Truth Social gains more users, revenue from advertising and subscriptions is expected to grow, though the timeline for profitability remains uncertain.

Is DWAC a Good Long-Term Investment?

DWAC offers a unique opportunity for investors seeking exposure to alternative media and politically driven markets. However, it also carries considerable risks due to its reliance on a niche user base, regulatory challenges, and high market volatility.

Key Considerations for Long-Term Holders:

- Risk Tolerance:

If you are a risk-averse investor, DWAC’s volatility may not align with your investment goals. - Market Trends:

Keep a close watch on user growth, revenue diversification, and competitive positioning. - Portfolio Diversification:

DWAC can be a part of a diversified portfolio but should not be the sole focus of long-term investment due to its high-risk nature.

Conclusion

For investors with a high-risk tolerance and an interest in alternative media platforms, DWAC stock could offer long-term growth potential. However, it’s essential to stay informed about the company’s financial performance, regulatory developments, and market trends.

As with any investment, thorough research and a clear understanding of your financial goals are crucial before committing to DWAC stock for the long term.

Post Comment